- Polkassembly/

- #1224/

Deploy 10m USD worth of KSM into KSM-ETH liquidity pool at Mangata Finance

Summary

The Kusama Treasury currently holds >488k KSM (140m USD as of today). The objective of the Treasury is to use the funds to stimulate Kusama ecosystem growth. One solution is to put them to use in DeFi in ways that invite new capital to flow into the Kusama ecosystem.

Mangata Finance is building a DEX (decentralized exchange) parachain that serves as a gateway between the Ethereum and Kusama ecosystems and optimizes for capital efficiency.

This proposal asks the Kusama Treasury to deploy 10m USD worth of KSM as liquidity for a KSM-ETH liquidity pool. This will achieve two main benefits for the Kusama ecosystem:

- Providing liquidity between the Ethereum and Kusama Ecosystems

- Protect a crucial liquidity channel between ETH and Kusama ecosystems from being dependent on mercenary liquidity providers that are not willing to commit on an ongoing basis.

The liquidity provided by the Treasury would still be owned by the Treasury.

Motivation

Facilitate Capital Flow between Ethereum and Kusama

A major bottleneck for the growth of the Kusama ecosystem is the fact that there are still not enough bridges that support flow of capital to and from the Ethereum ecosystem. Right now the easiest way is to use CEXes (centralized exchanges). This is not in the spirit of a decentralized and trustless ecosystem.

Bridges are still awaiting completion, but once they are completed, users need to be provided with the opportunity within our ecosystem to exchange Ethereum assets against Kusama assets and vice versa. DEXes will be fundamental in providing exposure for Ethereum users to KSM and Kusama ecosystem assets.

KSM-ETH pairs will therefore be one of the most important liquidity pairs and become important choke points that also need to be considered from an ecosystem development perspective.

Deep Liquidity for KSM-ETH pairs

For any market to be of interest for bigger capital holders, it is expected to be “deep”. This means that it should hold as much value as possible, half of the value provided by each asset. This allows the market to have more capital efficiency and less slippage, enables better price discovery and allows the market to express a price that is as close as possible to the fair value. In short: It becomes more attractive for everyone.

For a KSM-ETH pair that can act as a gateway between the two worlds, the interests of DeFi participants and the Kusama Treasury align: Deep Liquidity will facilitate a higher transaction volume and in our estimation more inflow of capital into the Kusama ecosystem. The Kusama Treasury should therefore seek to seed KSM-ETH pools with liquidity to provide more depth to the pools and provide attractive on-ramps into Kusama.

Why Mangata?

Mangata is building an app-specific DEX parachain built to allow capital to flow between the Ethereum and Kusama ecosystems. It optimizes for capital efficiency and solves very important problems that DeFi on EVM-chains is plagued with.

Mangata is creating a No Gas Economy, preventing front-running and MEV on the consensus layer with Themis Protocol and freeing up more capital usually used in staking for liquidity pools with the Proof-of-Liquidity mechanism.

Ethereum, Avalanche and Solana are plagued by MEV (e.g. spamming strategies that bloat the chains), which makes ecosystem usage more expensive for everyone, not only DeFi users. It is in the interest of the whole ecosystem to support solutions that prevent MEV and front-running on the fundamental layers.

Mangata believes that capital efficiency will be THE key deciding factor on the question of which protocols will be the most successful in DeFi. We aim to offer the best decentralized solution for on-chain capital exchange, becoming a more attractive alternative to CEXes.

Proposal

We propose that the Kusama Treasury deploys 10m USD worth of KSM into the KSM-ETH liquidity pool, once a Mangata parachain launched on Kusama and the respective pool is bootstrapping. Mangata expects this to happen in Q1 2022.

Quantifying appropriate liquidity provision

We estimate that a pool value of 20m USD is the lower bound for any liquidity pool that wants to be seriously considered for higher transaction volumes. We ask that the Kusama Treasury supports bootstrapping by providing half of that value, 10m USD in liquidity. This chapter will show how we arrive at this estimation.

When trading into KSM, investors need to consider the loss (called “slippage”) that is incurred by the act of swapping tokens. To allow more capital to flow into Kusama, DeFi needs to optimize for capital efficiency to reduce loss.

Slippage is a function of the depth (total value) of the liquidity pool, the fee structure and the market maker in use. We will ignore fee structure and market maker as both are very similarly solved across the DeFi landscape (most often 0.3% and the xyk invariant) and focus on the pool value.

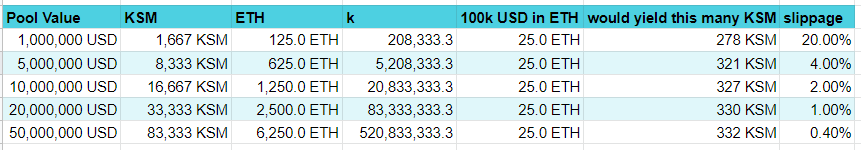

In the example below, we calculated slippage for various pool sizes. We assumed current KSM and ETH prices. A transaction volume of 100k USD is often assumed in such examples, which we also used here.

This calculation shows that providing 10m USD in liquidity reduces slippage to 2%; 20m USD in liquidity reduces slippage to 1%, which can be seen as important subjective barriers.

Choosing the transaction value for the example calculation has a large effect on the slippage that the calculation yields. We think 100,000 USD is the minimal value that has to be assumed when considering investors larger than retail. This means that the slippage percentages we arrived at in our examples are actually at the lower bounds of what slippage actually has to be expected when transacting higher volumes.

This leads us to the conclusion that any serious liquidity pool that acts as a gateway between Ethereum and Kusama has to be at least 20m USD deep.

Comparing existing key liquidity pools

At the time of writing this proposal, we compared liquidity pools of several DEXes that are important in the Kusama ecosystem.

- The ETH/MOVR pools on Solarbeam and Sushi (both Moonriver) have 7m USD in liquidity each

- wBTC/USDC on Zenlink (Bifrost) has 8m USD

- kUSD/KSM on Karura has 8m USD

We consider these liquidity amounts to not be sufficient to fully enable capital exchange with our ecosystem at the pace it deserves.

Why should the Treasury support a liquidity pool?

It is in the Treasuries interest to facilitate higher capital flow from and to the Kusama ecosystem and protect the capital chokepoints from being dependent on mercenary capital.

In general it can be said that it is a DEXes responsibility to attract enough liquidity to be able to render their services. This is usually done by a strong value proposition and team performance. The current trend however heavily focuses on liquidity mining programs, where DEXes rent liquidity from liquidity providers in exchange for native tokens (often termed “liquidity mining” or “bribes”). This is generally not considered to be a sustainable model for the long term, as mercenary capital is always looking for higher yield opportunities and can pull out liquidity at any point in time. At the same time it is now considered necessary for any new DEX to offer such programmes to attract new users.

While we do have the intention to support important pairs by proposing liquidity mining incentives to our governance, we acknowledge the likelihood that this skews the market and does add to the opaqueness of how much capital will actually be sticking with our markets.

This introduces the risk that liquidity providers may remove liquidity from the essential pools like KSM-ETH when it might be needed most, like under harsh market conditions. Sudden pulling of capital from a pool increases the probability for high slippage and volatility. This might affect less experienced retail users disproportionately.

For liquidity pools that are foundational for capital exchange between the large ecosystems, like KSM-ETH, it makes sense for the Kusama Treasury to provide depth to provide “liquidity rails” that benefit the overall ecosystem.

How long should the Treasury provide the liquidity?

We propose that the Treasury commits to providing the liquidity for a minimum of a year and until the depth of the liquidity pool is considered safe enough to maintain itself. A reevaluation of the situation should be done after a year and then again after certain time intervals (e.g. 3 months)

Rewards, risks and other considerations

Rewards

- If the treasury provides liquidity, that liquidity will be subject to 0.2% LP rewards from all volume transacted in that pool.

- The liquidity pool in question might become subject to liquidity mining rewards.

Risks

The usual risks that go with using DeFi apply, such as:

- Protocol Risk:

- We are relying on Substrate as base, while having made considerable contributions to our codebase that modify existing behavior.

- We modified block execution from the default Substrate implementation to prevent front-running and MEV.

- We replaced Proof-of-Stake with our new Proof-of-Liquidity model. This might introduce new attack vectors that have not yet been discovered.

- To mitigate those risks, we dedicate 2 full time QA engineers on our tech. A presentation of them can be found here: Quality Assurance at Mangata

- Impermanent Loss: All capital that is offered via liquidity provision is subject to impermanent loss. From the perspective of the Kusama Treasury, this risk or even loss might be considered acceptable, as it can be seen as an investment into the decentralization of the ecosystem and reduced friction of price discovery for KSM, as well as holding the doors open on the capital gateways of the ecosystem and protecting retail users from tectonic price shifts during harsh market conditions.

Execution of the Proposal

The execute the proposal, preconditions need to be met:

- Mangata is launched as a parachain on Kusama

- A bridge exists that can bridge ETH over to the Kusama ecosystem and into the Mangata Parachain.

- A KSM-ETH pool is at least in the bootstrapping phase.

We suggest that once the preconditions are met, the Kusama Treasury acquires 5m USD worth of ETH and provides it in a trustless fashion as liquidity into the Mangata KSM-ETH liquidity pool.