- Polkassembly/

- #1630/

Liquidity funding proposal for Genshiro Money Market and DEX

Proponent Address: DwazkqtParfuxYUYNwQCvAjXZaMACMN2VEVz3Hsc5vRwgir (msig)

Requested Amount: 25,000 KSM (to be spread out across multiple products as described further below)

Proposal Date: 17 June 2022

Short Description: Attract liquidity into Genshiro’s money market and DEX, incentivise KSM / EQD market liquidity and margin trading, further KSM network effects and benefit ecosystem with a first real margin trading and borrowing use case.

Context of the proposal:

Objectives:

Promote KSM adoption, give users enough liquidity and use-cases to participate in the ecosystem DEX trading of the KSM asset.

Promote the innovation Genshiro brings into the DeFi space, more specifically: our team utilizes financial math to come up with a closed-form solution to a classical collateralized loan problem; we use performance boost offered by the underlying substrate technology to price risks of borrowers and entire protocol solvency directly on-chain, which allows us to track individual borrower portfolios, their respective risk, and their contribution to the risk of the entire money market protocol, which is a step forward from classical approaches to on-chain overcollateralization to a more robust and financially sophisticated solution.

Provide liquidity for various in-protocol financial products for users to utilize promoting KSM adoption even further

Genshiro has built following suit of products available for ecosystem users:

Money Market where users can borrow and lend assets against portfolios of collateral

DEX where users can trade spot on margin with up to 5X leverage

Market Maker pools - mechanism to provide liquidity for designated DEX market makers

Liquidity is a crucial part of any ecosystem. If we consider the money market then it's crucial to have sufficient lendable liquidity which users may borrow to either speculate (e.g. sell short) or cover their liabilities elsewhere in the ecosystem or outside (we have bridges operating with Ethereum, BSC, HECO chains, launching Polkadot bridge and Polygon bridge).

When looking at a DEX, order book depth and tight spreads are the first things traders desire.

To make sure users enjoy sufficient liquidity from the start, the Genshiro team aims to attract KSM liquidity into the protocol, where it will be distributed among different products and pools to facilitate KSM DEX trading, KSM borrowing. This initiative will promote KSM velocity inside the ecosystem, educate community about possible ways this liquidity may be utilised and strengthen the cross-chain communications both within and beyond Kusama

Problem statement:

Low levels of liquidity in the order. book in the Genshiro DEX, as a consequence - inability to trade on the DEX by ecosystem users. It’s a chicken/egg problem for all DEX-es - you need more users to have more liquidity, you need more liquidity to make your DEX attractive for more users. Someone needs to put initial liquidity into order books first to kickstart the process.

Low levels of lendable liquidity in the money market, as a consequence - inability for users to borrow or trade on margin.

Low levels of stablecoin (EQD) supply, as a consequence - low liquidity inside AMMs and elsewhere

In general, low levels of liquidity in classical DeFi protocols lead to inability or unwillingness of users to utilize the system. We believe that it's of paramount importance for the "DotSama" ecosystem to kickstart activities inside the ecosystem to bolster liquidity, widen adoption, and increase in KSM velocity, all while elevating user/holder interest to various ecosystem projects

Proposal Objective/solution:

Goals:

To attract bid side and ask side liquidity to the ecosystem-wide fully on-chain order book based KSM asset trading.

To provide designated market makers with inventory to support tight spreads and liquid order book.

To attract liquidity into the insurance pool to make the protocol secure, more liquid and to provide lendable assets for borrowers

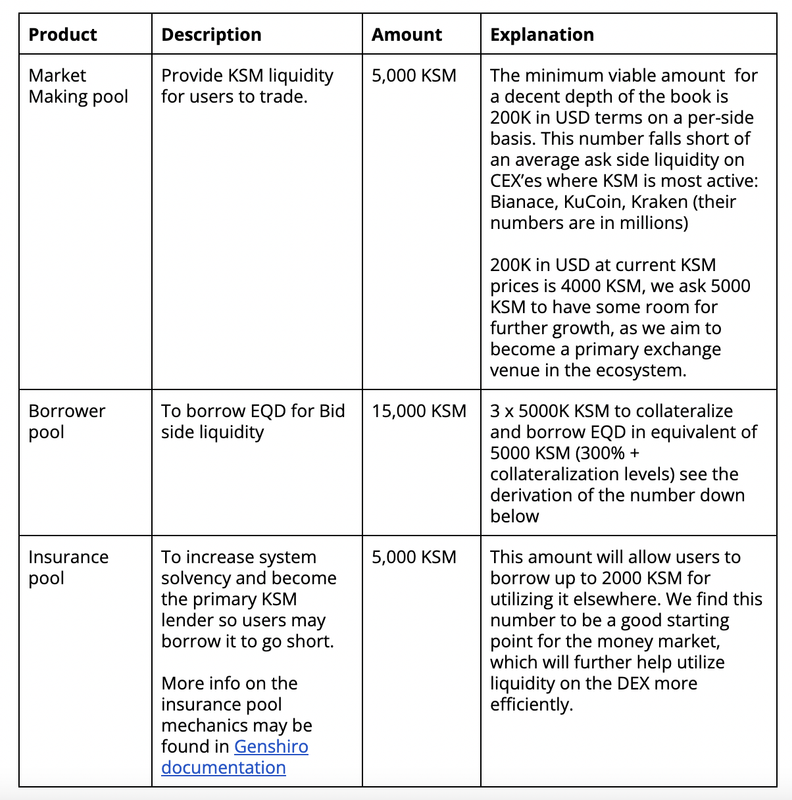

Requested amounts:

Link from table: Genshiro documentation

Market maker pool

5,000 KSM will go directly to a market maker pool, where the assets will be available for borrowing to the list of designated market makers.

Designated market makers are professional traders and liquidity providers of crypto assets and Equilibrium has onboarded PNYX Ventures market maker so far. We’re in talks with other known names in the space and will announce them if and when negotiations are complete.PNYX ventures is a blockchain venture firm with focus on the DotSama ecosystem and extensive trading on exchanges such as Gate.io, Kucoin, and Huobi.

The borrowing is performed in a trustless non-custodial non-collateralized manner. The details of the mechanics of market maker pools are available here and here.

Borrower pool

15,000 KSM for bid side liquidity will go to the collateral pool, to be used as collateral to generate EQD stablecoins against it.

Unlike the now infamous UST stablecoin, EQD is a collateral backed stablecoin and not an algorithmic one. With Equilibrium’s unique approach to pricing risks on-chain, EQD unlike other collateral backed stablecoins has a 3 layer protection system:

- First layer: overcollateralization of borrower positions.

- Second layer: insurance fund which absorbs borrower liquidations

- Equilibrium treasury which stands ready to recapitalise insurers in case they go bust.

Currently the treasury in Genshiro holds 15% of the entire GENS supply (~ $ 900K at current prices). 50% of the entire treasury supply (7.5% of total token supply) are set aside for recapitalisation purposes in following cases:

- 7.5% (~ $450K at the current prices) to provide additional collateral to the 15000 KSM (~ $750K at current prices) position in case it becomes risky (see risks section below).

The treasury is controlled by Genshiro multisig 3 of 3, Genshiro team will be responsible for monitoring position conditions and in case the position approaches liquidation, our team stands ready to recapitalise it to safe collateralization levels.

The safe collateralization level will be set at an average of the worst 1% of KSM weekly returns (expected shortfall) over a series of simulations. This is a risk measure used to evaluate the market risk or credit risk of a portfolio. The “expected shortfall at q% level” is the expected return on the portfolio in the worst q% of cases.

Returns distribution will be modelled using the Merton-Jump-Diffusion process which is a combination of diffusion and jump processes. Maximum likelihood estimators for distribution parameters will be calculated based on the historical KSM-USDT price series starting from 1 Jan 2021. Simulation code may be accessed here.

Simulations suggest that a very conservative collateralization ratio of 320% + should be used. This means that for 15,000 KSM at $50 price ~250K EQD may be borrowed and further distributed to the market maker pool and the insurance pool. We want to be as conservative as possible to mitigate risks of liquidations at the time of market downturn. This is the primary reason we put up our treasury funds for recapitalisation purposes as described above. We’ve observed this very situation during the latest downtrend in several other ecosystems where DeFi liquidations in Ethereum and some of its forks topped $1B in value.

Insurance pool

5000 KSM will go to the insurance pool which simultaneously acts as a lending facility, 40% of the entire supply will be available for users to borrow (2000 KSM). Users may utilize this borrowed liquidity at their discretion and pay interest fees for doing so. Primary usage is short selling or covering liabilities elsewhere in the Kusama ecosystem.

Period:

We request funds to be locked for a period of 1 year (52 week) We believe the period of 1 year is the right amount of time to achieve stated goals and show the growth of the DEX adoption and trading volumes.

Success metrics:

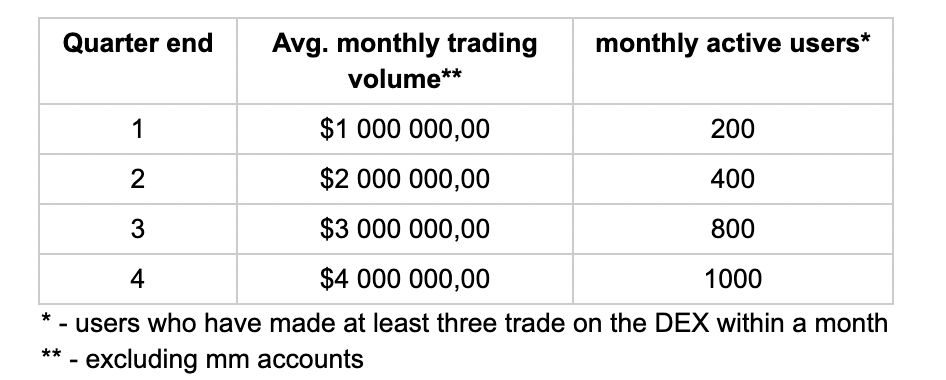

DEX success metrics

Trading volume metrics related to KSM/EQD pair:

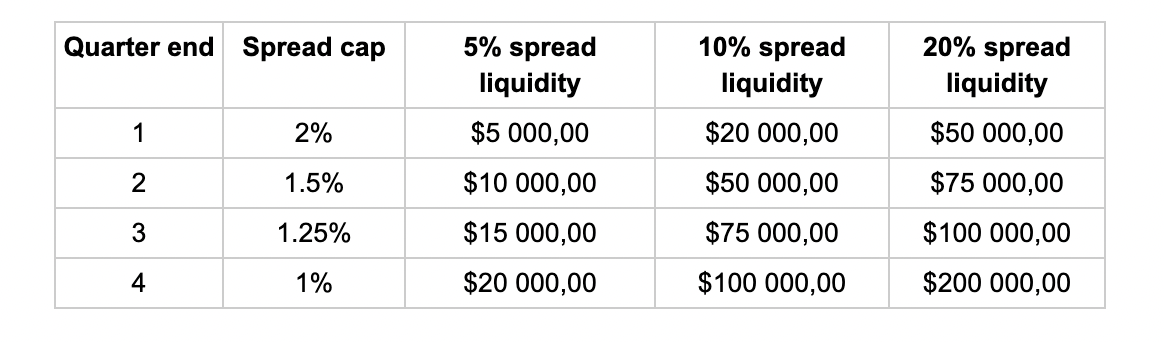

**Depth: **

Average spread and liquidity numbers calculated for the period of 7 days (1 Genshiro epoch) should fall within following limits at the end of each 3 month period:

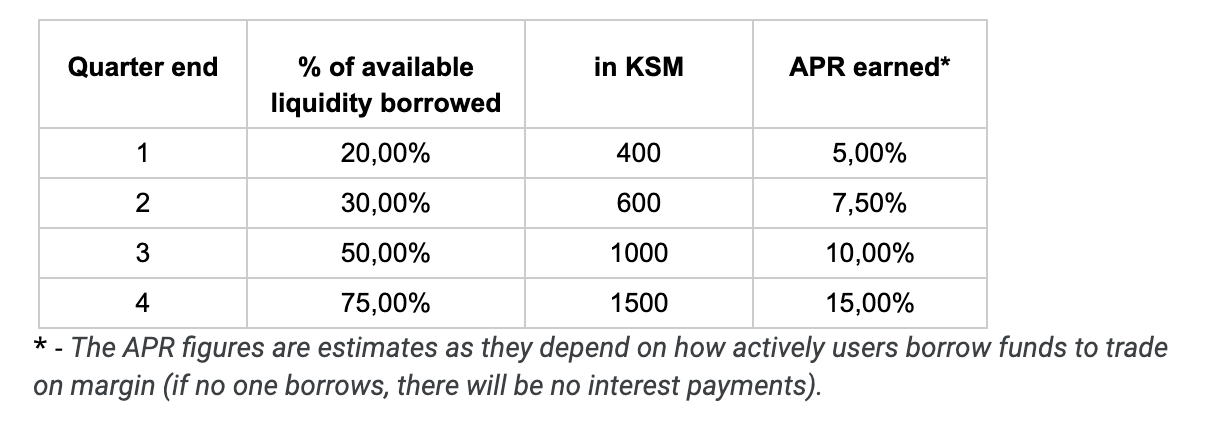

Insurance pool (Money Market) success metrics

40% of 5000 KSM of the insurance pool is available as lending liquidity, the success of the money market in this regard will be related to the amounts of KSM borrowed by users. We also provide APR returns which are expected to be earned solely from borrowers (excluding liquidity farming rewards)

On top of that we have a separate liquidity farming program and its mechanics may be found here, so the treasury liquidity will be a primary beneficiary of this program and will earn around 15 to 20% APR on top of everything coming from the borrowers

Rewards: KSM liquidity will generate liquidity farming rewards according to Genshiro’s liquidity farming module. The details of how the module operates and how rewards are calculated may be found in the Genshiro docs. Liquidity providers may expect rewards up to 20% APR in Genshiro GENS tokens.

Borrower pool (Money market) success metrics

The EQD stablecoin liquidity borrowed against KSM collateral will subsequently be used in the Money Market pool to incentivise more liquidity and trading in the KSM/EQD trading pair which will affect up KSM velocity and utilization. So the success metrics are related to the Market Maker pool. DEX success metrics take this fact into account.

Responsibility for not achieving success metrics

We will research into the problem of why we didn't achieve stated goals and will engage in public discussion about it, we already provide farming rewards out of the box when liquidity is brought into the system and if for some reason we don't find user base or see elevated pick up of trading volume on the DEX, all funds will be returned back to the Kusama treasury at the end of the requested program period along with all the rewards earned from keeping the liquidity inside Genshiro.

There are no incentives for Equilibrium team to artificially inflate the numbers to achieve stated goals, as we want to achieve them for following primary reasons:

To indicate that DEX is indeed the product which is in demand among ecosystem users.

To showcase the substrate technology and the speed of transactions with the fully on-chain order book.

To gather user feedback to improve our products further.

To showcase our money market with high leverage and the DEX product we've built on top of it.

If we don't achieve stated goals its a serious question for consideration of why we didn't manage to do so:

- Our marketing activities were weak / wrong

- DEX is not a product users want.

- Some external factors (e.g. weaker Kusama interest, compared to Polkadot, for example)

- Lack of diverse trading pairs (currently we have only KSM and need similar amounts of liquidity to launch others)

We do have user analytics set up and we also track some user metrics to be able to answer these questions in the future.

Responsibilities

Liquidity provisioning will be done in a trustless way:

A special purpose multisig account with 5 signatories (Genshiro, GBV Capital, DFG, PNYX Ventures, Signum capital) and threshold of 4 will be set up. Kusama treasury will fund this account directly. All further transactions will be performed from this msig address

Msig address will distribute received funds across Genshiro products as specified below:

Initiate XCM transfer to the Genshiro parachain.

Put 5,000 KSM of liquidity directly into the corresponding Market Making pool.

Put 15,000 KSM of liquidity into borrower pool to mint EQD stablecoins as a borrower and then split EQD stablecoins between the corresponding Market Making pool and the insurance pool.

Put 5,000 KSM of liquidity inside the insurance pool, acting as a lender. This liquidity may be combined with EQD liquidity to have a KSM / EQD mix inside the pool to lower portfolio volatility.

The primary contact person for any issues that may arise during the liquidity provision and further liquidity utilization is Peter Sergeev:

Telegram: @pstr1

Element: @peter_str:matrix.org

Email: [email protected]

Potential risks:

- Borrower insolvency

Description: Collateralized position with KSM as collateral and EQD as debt may become insolvent if KSM price experiences significant downward pressure.

Mitigation: Carefully selected overcollateralization requirements calculated from assessment of price and jump risks of KSM token will mitigate possible insolvency conditions. Further discounts may be applied to mitigate this risk even more to adjust it with desired tolerance.

The Genshiro team stands ready to recapitalise the position with assets from its treasury in case the borrower position will approach some critical margin levels. In particular, if maintenance margin of 10% (see here) is reached on the position, it will be recapitalised back to safe levels of the collateralization as described in the Borrower pool section above.

Liquidity providers have means to increase collateralization levels at their discretion. Reduction of stablecoin debt also helps the process.

- Market Maker loss

Description: Market makers borrowing from the liquidity staking pool cannot move borrowed funds outside of the protocol. Yet, staked assets could be lost if a market maker were to lose funds due to unprofitable trading and be unable to replenish its borrowed allocations.

Mitigation: Liquidity provider’s funds may be subject to socialised losses: the number of funds lost will be split among all withdrawing users pro-rata their withdrawal amounts. In case of a default, the market maker loses the ability to borrow additional funds from the pool he defaulted on.Further, market makers accounts may be credited with liabilities in EQD tokens in the full amount of the loss. EQD tokens may be distributed among liquidity providers to cover their losses.

- Liquidation insolvency

Description: When borrowers liquidate, insurers receive their collateral and debt pro-rata their liquidity in the insurance pool. There is a 5% penalty which insurers collect from borrowers when they liquidate, along with the interest borrowers pay in the system. It may happen so that the value of liquidated collateral will drop below the value of ~100% + 5% of liquidated debt + all the interest fees collected, in this case the insurer will be sitting on the unrealized loss on his position.

Mitigation: With a proposed amount of 5,000 KSM for the insurance pool, roughly 15% of all liquidation volumes will end up on the large Kusama treasury KSM insurer. Keep a mix of KSM and EQD in the insurance pool, so you always have liquidity to cover debt in both EQD (when leveraged longs are liquidated) and in KSM (when short sellers are liquidated). More on insurance pool mechanics here.

- Impermanent loss

Description: Impermanent loss happens when the price of your tokens changes compared to when you deposited them in the pool. The larger the change is, the bigger the loss.

Mitigation: This loss doesn’t really depend on the location of where KSM is stored - Kusama treasury or Genshiro MM pool and has to be addressed by the Kusama treasury itself.

Reporting

Reporting will take the form of periodical posts (once a month) on Polkassembly in the Timeline section of the original on-chain proposal as comments.

Monitoring

DEX

- Weekly active takers: no of unique accounts who made at least 1 trade during the epoch

- Weekly volume by trading pair: EQD value of all trades (buys + sells) across DEX pairs (start with KSM / EQD pair). Two metrics: full volume and excluding the MM account.

- Bid / ask spread: average data: hourly interval - average spread over 10 blocks (1 minute), show 60 minute points daily interval - average minute spread over 60 minutes (1 hour), show 24 hour points

- Volume at 5%, 10%, 20% spread: average data: hourly interval - average spread over 10 blocks (1 minute), show 60 minute points, daily interval - average minute spread over 60 minutes (1 hour), show 24 hour points

Money Market

- Weekly liquidation values: total collateral value at the time of liquidation, total debt value at the time of liquidation summed across epoch

- Weekly open interest: weekly values of total asset debt outstanding (start with KSM and EQD, calculate in asset)

- Weekly interest paid: calculated in GENS from borrowers (excluding farming and liquidations)

Audits

Audit of the Equilibrium’s core protocol logic was performed by Quantstamp

Additional considerations / questions:

After the end of the program, all the funds left from various activities return to the kusama treasury, right?

Correct, the account responsible for the funds management (the msig) will return funds after the one year period. The maximum possible risk here is that all amount of KSM borrowed (2000 KSM) may not be returned by borrowers, in case of their liquidation you will receive their collateral plus a premium of 5% and all the interest fees.

You already had an MM stimulation program, why was it not successful? What are the changes in this program and why will this program be successful?

The main challenge is that users want to see some initial liquidity before bringing their own money into the pools.

From your liquidation documentation: "These parameters will most likely change to a more conservative setting to avoid unnecessary risks associated with low liquidity levels at this stage". Will the settings be changed? At the moment they seem to be quite aggressive.

We already did change margin parameters to be more conservative: before we had 5%, 2.5% and 1% for initial, maintenance and critical margin respectively, now we have 20%, 10% and 5%. We're also working on a unified system of discounts on illiquid assets in the system.

The program looks risk-free for MMs (if they go into the red, then the treasury funds will be used, if they earn, they will earn themselves), which automatically creates a desire to increase the risk if it is free. It may be necessary to add some kind of responsibility to the MMs so that there is no desire to act with maximum risk.

When MMs do not return funds borrowed from MM pools they are charged with debt in stable coins and those stablecoins are returned to users in return for their funds. MMs pay interest on these stablecoin just like any other users and are able to move their liquidity around only after they repay this debt in full.